Sunday, August 30, 2009

Leaked Video - Paul Tudor Jones- Trading Documentary

Back in 1987 PBS apparently ran a special series on Traders. I am unsure how many entries were in this series, if anyone has that information by all means please share it. One of these entries, however, I had heard about a couple of years ago but could not find the video anywhere on the net, it was as it had just vanished. It is just about an hour long video of a couple of trading days in the life of Paul Tudor Jones.

Wikipedia entry - http://en.wikipedia.org/wiki/Paul_Tudor_Jones

Forbes 400 Richest - http://www.forbes.com/lists/2008/54/400list08_Paul-Tudor-Jones-II_L6IH.html

Paul is a very successful Hedge fund manager. He trades Stocks, Forex, Futures, Commodities, you name it. He made $750 million in 2006, and predicted the 1987 stock market crash as you will see a little bit of in the video. He was also featured in Jack Swager's book Market Wizards: Interviews with Top Traders, which is a wonderful book of interviews of successful traders.

This video has recently popped back up on the web, which I thank fellow trader Darko for bringing to my attention. Instead of linking you an outside source for the video, I chose to host it myself here at SmartPip.com, should it ever try and vanish from the internet again.

This video is a wonderful insight of the trader's mindset that many do not ever get to see. Sure it is old news now, but the same intuition and emotions that you see him deal with in this video are still extremely relevant in today's trading environment. If you are a trader or working on becoming one, I highly recommend you watch this in it's entirety.

I truly hope you enjoy this video as I did, grab a cup of java, and watch it as much as you like, just click the picture of Paul to head to the video. I love the "Losers Average Losers" comment on his wall here by the way. If you like this video, please take a moment to leave any quick comment here on the blog. Thanks =)

ps. Take note that in one part of the video Paul talks about helping inner city children get into college. With a little research I found very recent talk that Paul gave where he discusses how that worked out. He calls it the Perfect Failure. If you wish to read this, please look for the PDF link right under the video, or just click the PDF logo if you have already seen the video.

Please share this link via your Facebook, Twitter etc., so that other traders can possibly benefit from Paul's video.

Saturday, August 22, 2009

A Message From the Forex Trader's Wife...

August 22, 2009 by FXWife

To start, as a FOREX Trader’s Wife I will be so bold as to speak for all those who fall into my category; those who are the husband, wife, partner or significant other of a FOREX Trader, or stocks/options trader as well. This message could really come from anyone who has intimate knowledge, of who you are, someone who is personally invested in your life and well being. This message may seem simple, and easily dismissed; but, it is very important for you to understand. So here is to hoping that you are both open and receptive to what we are about to say to you.

WE KNOW MORE THAN YOU THINK WE DO !

Admittedly, we are clueless, for the most part, when we look at all those fancy charts of yours. No, we may not know exactly what a Bollinger band is, or the importance of a stochastic cross. Nor could we possibly fully embrace the elation felt when seeing a carefully planned, successfully executed trade run to its fullest potential without drawbacks; also, it is beyond our scope of understanding to clearly empathize with the horror of knowing that our capital account has just taken a severe hit due to our inability to let go of a trade that has clearly gone to hell in a hand basket. However, what we do know is you, both inside and out. The good, the bad, and the ugly, we are intimately in tune with who you are; and we are able to read those small non verbal cues that let us know what you are experiencing.

YOU ARE NOT IN THIS ALONE!

Seriously, do you think the weight of the entire world is on your shoulders alone? We are in this with you, so have a bit of consideration and communicate with us. We know when you are having a great trading day; more importantly, we know when you are having a bad trading day. Honestly, it is no secret when things are going poorly for you in the market, so if we come to you and offer you a word of encouragement, or support don’t go dismissing us arbitrarily, it may be just what you need in that moment of self loathing and self doubt. Every now and then we understand the importance of a strong dose of confidence boosting and how it can help to realign you with yourself and your positive attitude. Conversely, we also know when it is time for a good swat on the back of the head to bring you back down off that cloud your floating on. That is our job; we are here for support and understanding; as well as harsh truth and straight talk.

SO HOW ABOUT A LITTLE TRUST ?

Trust that we are not going to judge you when you mess up; also, trust that we know when the time has come for you to step away, and heed our advice and step away. Trust that we will be open to your need of reinvestment capital when you have a devastating trading day. However, trust that when we ask you what you are going to do to improve, that we are only looking to help you move forward and not dwell on the previous mistakes. In return, we will trust that you are working confidently on always doing the best you can with what is admittedly an extremely difficult profession. We will trust that you are not holding back any bad news from us that will hit us like a steam roller when you hit rock bottom.

TOGETHER

Together we will always be stronger and more confident than we are on our own. Together we can make this journey a joyful and profitable adventure.

Together we are in this for the good and the bad. Now let's make some pips!

Sunday, August 9, 2009

SmartPip.com blog introduction and purpose...

Hello everyone!

My name is Chris, and I am a full time currency trader in the FOREX (Foreign Exchange Market). I began trading in September 2005, and had quite a tumultuous beginning to my Forex career. It was not until I battled the emotional demons within that I was able to realize consistent success in the Forex marketplace. It does not take one very long to realize that this trading business is a far more involved, intricate, complicated, and challenging endeavor than most take it for when first introduced to it. Forex absolutely demands your complete commitment if you wish to ever have any hope of long term success.

With that said, me and my wife chose to start this blog at SmartPip.com. I have lived through a lot (and so has my wife), first bad, then fantastic, in the Forex world. I have now been a full time Forex trader for three years or so since posting this introduction. I plan to use some of the growing pains I went through to create in-depth articles along with my wife, who is far better at wording my thoughts, that might help others avoid the some of the same pitfalls I endured. Forex is a lonely business, you need to know you are not the only soul on the other end of that chart you are looking at. Also, I wish to share many of the fantastic resources out there that helped me along the way. All in hopes of helping, even if only a few of you potential traders out there, find your path to success.

Hey make no mistake about it... Forex is HARD, and you must commit long term to make it work. There is a reason most people lose in this business, they do not put in the necessary time and work to get through to the other side. This blog will NOT be here to 'Teach' you how to trade Forex, nor will I go over any specific trades, or methodology. There are more than enough resources on the internet, and in print, to fulfill that need. Consider SmartPip.com more as an inside look of a full time traders mindset, good and bad, over the course of several years, for you to possibly connect with and relate to.

I do hope you will gain some help from what we post on this blog in the future. I cannot promise extremely regular intervals of updates, but I will promise that everything that is posted will be of value to a 'real' trader.

Best Regards,

Chris

Understanding the magnitude of the multiple facets of managing your risk … yes, it is that important.

August 9, 2009 by FXChris & Wife

Each day you wake up in the morning and immediately begin to face the many risks that are present in your lives. From the very start you face small risks that could prove to be the start of a rough day; for example, you risk stepping onto the cold floor, stubbing your toe on the edge of the dresser, slipping in the bathtub, or cutting yourself shaving, Generally, none of these risks may seem to be particularly alarming to you as a singular event; however, what you need to consider is not only do they exist, but any one of them will set the tone for whether your day proceeds in a positive or negative manner when it comes to your disposition; and that one small seemingly insignificant event could be the trigger to what in the end turns out to be a nightmare of a day. With that said, it is extremely important as currency traders to understand that forex trading is really no different given that there are inherent risks that come from trading currencies. It is indeed, the very nature of the beast that is forex to be full of risks that are to be anticipated and sometimes manipulated; additionally, there are the unforeseen, unpredictable and uncontrollable risks that come from the fact that the world is a living, breathing force that is ever changing. Furthermore, it is imperative that as traders you not only understand that there are a multitude of risks to be faced each trading day, but that you embrace this fact firmly, since until you do there is no hope of your being able to discover your personal risk tolerance level, or perform any type of risk assessment, which could likely be the most important aspect of your trading, since without the proper assessment of risk there can be no effective form of risk planning or management.

Notably, proper risk management is an integral part of any trade plan, whether you are trading long or short, or you are a carry trader or a scalp trader, the management of your risk can not be successfully accomplished until you have a clear and concrete understanding of what your risk tolerance level is. In the world of foreign exchange trading the term risk tolerance means your ability to handle any type of decline in your trade fund account. Realistically, it is absurd to think that there will never be a time when your trade account sees a decline. It does not matter who you are or how good you are at choosing, planning and executing your trades, there are always going to be circumstances which are beyond your control; therefore, it must be a critical part of your trading routine to know with one hundred percent certainty what amount of money you are willing to accept as a loss. This leads naturally to the question, how is your tolerance of risk determined?

First, it is especially important to understand that risk tolerance is not a fixed amount that is etched in stone. Your tolerance level, whatever it may be, must be reevaluated and readjusted when the circumstances warrant it. Now back to the question at hand, how is your risk tolerance level determined? This is a question that can be answered best by you. Yes, there are professionals out there who make their living by providing guidance in this area; however, it is more often than not the case that you yourself are the one that has the clearest understanding of what is a reasonable and acceptable level of tolerance when it comes to any level of fund depreciation. The challenges typically come from a person’s inability to be completely honest about who they really are, therefore there is the tendency to over or under estimate your specific level of tolerance.

Vitally, you must be completely honest with yourself about who you are and what personality traits make you uniquely you. Own your quarks and embrace them whole heartedly, given that if you don’t the consequences of miscalculating your risk tolerance level could singly destroy your ability to execute your trades, thereby prohibiting any gains in profit; or worse, it could wipe your trading funds out completely. Ask yourself, do you tend to be driven by fear or greed when it comes to your money. Do you thrive on taking risks in your daily life or are you so overly cautious that you never leave the safety of your home. If you enjoy the occasional game of poker, are you constantly trying to get all your chips in the pot or are you hording them so tightly that you are getting blinded to death. You see, there is no wrong answer, you are who you are and there is absolutely nothing wrong with that. What is key though is being completely honest about who you are so that you can make the necessary adjustments in your trade plans to protect yourself from any potential harm, and this is what the determination of a proper risk tolerance level can do for you, protect you from any potential harm.

In addition to the consideration of your personality traits, you need to have a firm understanding of the value of your forex fund account. You have to know positively what the amount of money available for trading is without worrying about any other financial obligations; this money should be considered risk capital. Moreover, it is crucial to be aware of your forex account value because as your account value increases your level of risk tolerance should decrease proportionately. For example, if you are trading a mini account with $10,000.00 and you have decided that you are willing to lose no more than $300.00 on any one trade then you have a risk tolerance level of three percent; however, after slowly increasing the value of your forex account over time to a respectable $1,000,000.00 that three percent now becomes a staggering $30,000.00 loss. Now, to be honest, if you have a disposable income of $1,000,000.00 you may not think that $30,000.00 is that bad of a loss; never the less, it should stand to reason that there is no reason to be risking that large a part of your funds on any one given trade. Sensibly, you should be decreasing that level of risk to say .05 percent by this time, because frankly how much money does one person genuinely need to not only survive, but to maintain a particularly comfortable lifestyle?

This brings us to the practice of risk assessment, which according to businessdictionary.com “involves the identification, evaluation, and estimation of the level of risks involved in a situation, their comparison against benchmarks or standards, and the determination of an acceptable level of risk.” This is an excellent description of what risk assessment is, nevertheless it does nothing to help you understand why it is so critical to perform this assessment, or more importantly how to make this assessment so that you can successfully manage your trades.

Plainly put, the question of why assess your risk comes down to two simple words, margin call. For those of you who have not experienced this calamitous moment in your trading career, it is best likened to H.G. Wells Time Machine, where the scientist sits upon the time machine watching as the rest of the world passes before his eyes at an unimaginable pace, saddened and sickened by what he is witnessing, yet he is powerless to change any of the events that are going on around him. What is a margin call? It is likely to be the end of countless forex trading careers; more specifically, it is the point in time when your trading account equity is equal to or exceeded by the amount of used margin.

The margin call occurs in your margin account due to the fact that you are using the leverage graciously being loaned to you by your broker to achieve the prodigious profits that all forex traders dream of. In today’s trading market the amount of leverage granted by the individual brokers varies anywhere from 100:1, 200:1 or even 400:1 depending on several different factors which vary from brokerage firm to brokerage firm. The key to leverage is to remember the simple mantra, just because you can doesn’t mean you should. Meaning, just because you can trade at leverage of 200:1 thereby augmenting your available capital to achieve those pie in the sky profits that you hear of, doesn’t mean you should risk your entire fund account to do so. You see, no matter how tempting it may be, the risk is in no way worth the gamble; and it is indeed a gamble, because as we discussed earlier there are always going to be the unexpected volatile swings in the market that you have no control of and cannot recover from fast enough to stop the devastation.

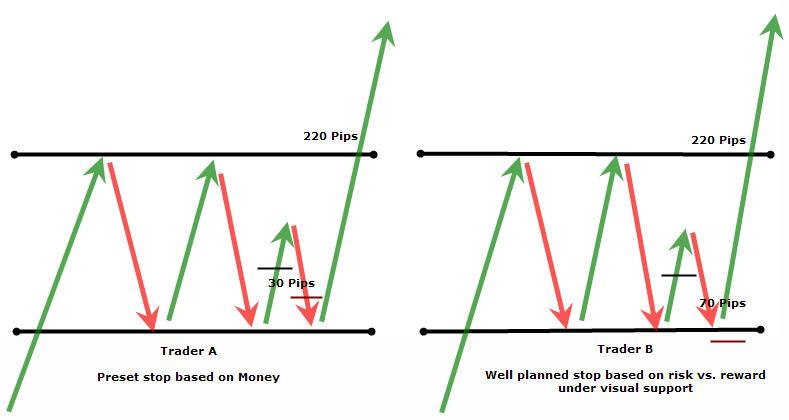

Having an understanding and respect for the proper amount of leverage allows you to clearly and judicially put into place the protection mechanisms necessary for good risk management. Considerably, one of the best protective mechanisms available to the educated trader is the placement of the stop loss. Simply, the stop loss is exactly as its name implies, it is a point in the trade where you place a stop behind the support or resistance so you can comfortably let the trade work its way to fruition without exceeding you predetermined risk tolerance level, without staring at the screen with eyes the size of saucers, holding your breath to the brink of unconsciousness, or on the verge of a mental break down due to the stress that comes with uncertainty. Consequently, by not understanding the enormity of the danger that comes with this uncertainty, you open the door to emotional trading, and that is a house guest that will definitely overstay its welcome. When you understand and respect the risk and have a predetermined level of tolerance to this risk you can employ the tools that are available to you that will all but eliminate the deadly emotional trader who is hiding in the dark recesses of your soul. Without this predetermined level you release the fiend that is emotional trading allowing the possibility for chasing price, over-leveraging, eliminating stops, revenge trading doubling up, living in denial and having no diary or journal, and worst of all having NO TRADE PLAN! Your sign now reads: “Hello, my name is Tom the Trader and I am a proud member of the 95% club, I have proudly joined 95% of the traders out there who fail as a foreign exchange trader, and now I am off to see if Joe the Plumber has any job openings”. Don’t join Tom in the 95% club, follow the example of Trader B and use the properly placed stop illustrated below, so that you don’t miss out on the potential for profit like Trader A who was stopped out due to the fact that while he did put in a stop, he was driven by the money not the proper technical support which caused him to get stopped out before realizing any profit; thereby, exsaserbating the potential for more emotional trades.

In the end, you can now see that it is essential to understand that with a predetermined risk tolerance level, combined with diligent risk assessment you will be able to manage the potential risk to your trading account with confidence and effortlessness, allowing your trading to expand to levels that you have heard others speak of but to date have been completely clueless as to how they were achieving such rewards. By understanding the importance of risk acceptance, tolerance, and management you can go on to confidently adjust your trade amount to fit the plan, not to adjust the plan to fit the trade. In doing so you are eliminating any possibility of emotional trading where you freeze on the trigger preventing profit, that you deny the fact that your trade is a loser and let the profit disappear, or perhaps worst of all, that you refuse to accept any loss what so ever and continue to throw more money into the losing trade anticipating a different result. It is of the utmost urgency that you understand to be a successful trader you must first and foremost preserve your capital, then capital acquisition, and finally capital appreciation. This can all start with the acknowledgment that risk is indeed inevitable and it is better to be prepared for its arrival than to be blindsided by it when it shows up, because like a hurricane in August it will arrive with deadly force.